Market Thoughts

A bunch of thoughts on the current market for the rest of Q3 and Q4.

Recap of the past week

This week has been a crazy and volatile week, to say the least. BTC rallied 20% in 5 days from the local bottom it put in at 18.6k, only to correct most of the move after a miss on CPI numbers suggesting that inflation is here to stay for a while. On the other hand, ETH during the BTC rally lagged as people were cautious before the merge. The biggest event of this week was the ETH merge going through successfully. This led to a sell the news event for ETH on Thursday, making the asset go down 10%.

Market/Macro View

CPI data came out on Tuesday, and it was a miss, with estimates being at 8.1% for CPI (Actual 8.3%) and 6.1% for Core CPI (Actual 6.3%). This bad CPI print gives the Fed more firepower to remain hawkish and strict on tightening monetary policy.

Tightening monetary policy leads to liquidity lowering, earnings heading down due to loans becoming expensive to pay off, and people saving more and spending less hence bad for the economy, all in all, bad for markets.

I tend to lean bearish/neutral for the rest of Q3 and the entire Q4. I believe every rally is for selling stocks/crypto until we get capitulation in the stock market or when the Fed turns dovish.

Few more reasons why I am bearish:

The job market also suggests that the Fed can continue its scheduled rate hikes as non-farm payroll data recently came in higher than expected, showing that jobs have not slowed down yet.

I also believe supply chain issues caused by the Russia/Ukraine conflict will cause commodities like crude oil and natural gas to remain at high prices or even climb higher.

FedEx came out and said they can't provide 2023 guidance anymore, which shows that demand is weakening for companies as people are not spending as much. Also, FedEx's CEO clearly stated that he expects a worldwide recession.

A Fed pivot is not coming anytime soon, and the Fed will keep hiking until inflation heads down or if the stock market crashes, which in that case, they will be forced to soften up their stance.

Charts Overview

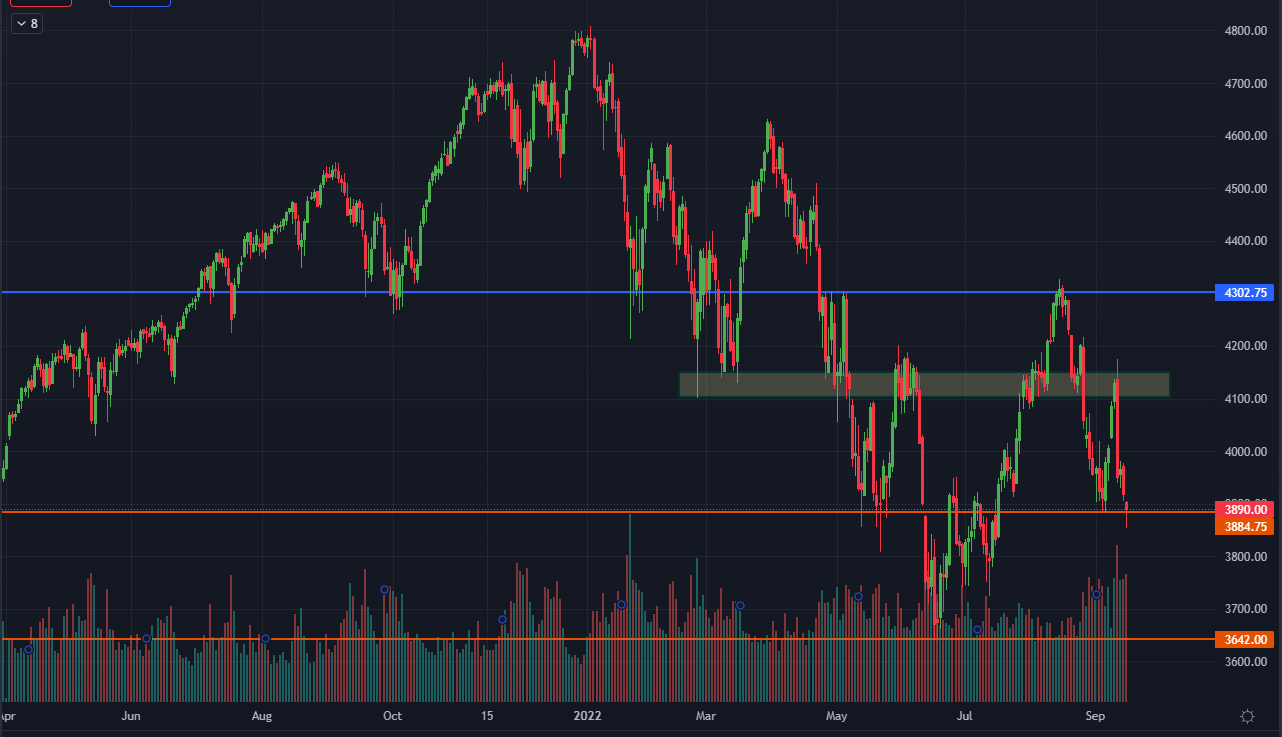

SPY

SPY, since the June low, had an over 15% bear market rally and tagged May’s high at 4.3k.

SPY is currently sitting at support, a break of support probably means we head back to range lows, and if we bounce from here, I think we have a chance to tag 4.1k SPY briefly before heading lower.

FOMC is coming up on Sept 20 - Sept 21, which will define the move of the SPY. I think a 75 bps hike will give the market some relief, while a 100 bps hike, which is highly unlikely but still possible, would crash the markets and I would expect a swift move to range lows.

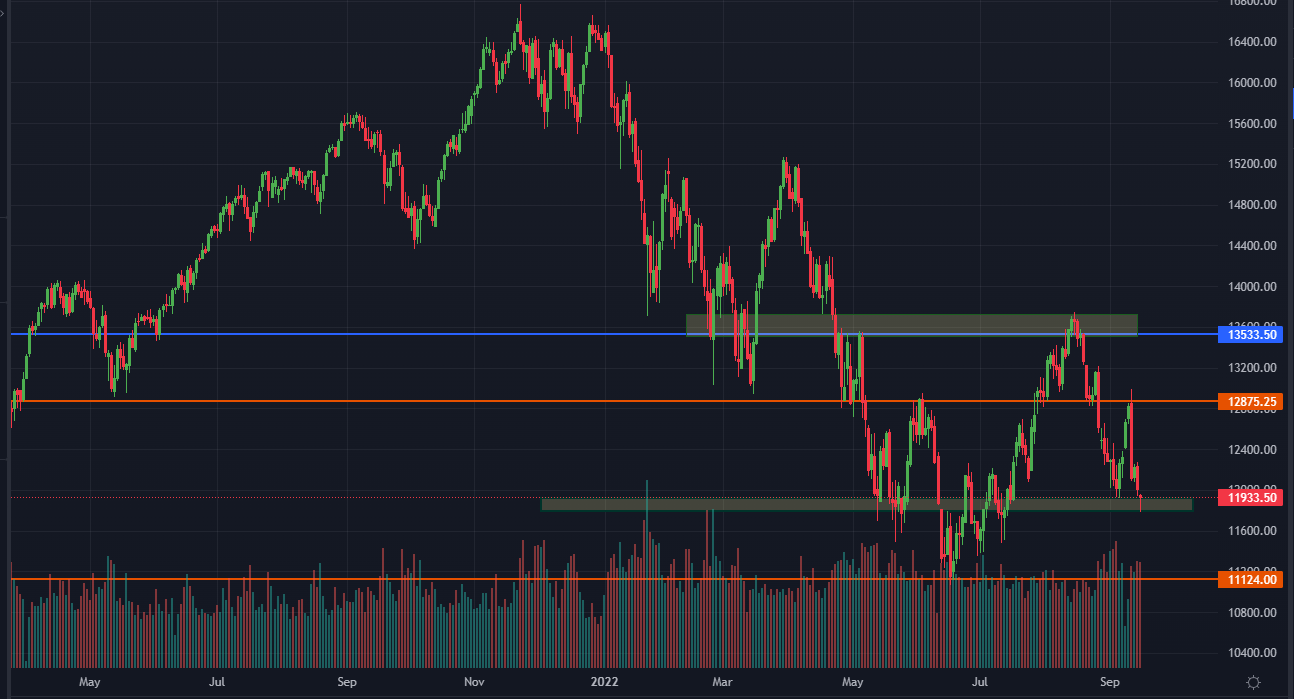

Nasdaq

Nasdaq, since the June low, has had a massive bear market rally of over 20% and briefly breached its May high before coming back down.

Nasdaq is also sitting at support, and if a breakdown happens, I would expect it to reach range lows quicker than the SPY. If a bounce occurs, I can see it reaching 12.8k before returning to range lows.

Regarding FOMC, I have the same views for the Nasdaq as I do for the SPY. The Nasdaq, as usual, will be a beta play on the SPY.

BTC

BTC, from its June low at 17.6k, had a good rally but compared to ETH, it was pretty weak throughout the summer. Many swing failure patterns happened numerous times above 24.2k before returning into the range.

BTC’s chart doesn’t look good at all after it retraced most of the strong rally it had earlier in the week, it looks to me like we might bounce to 20.8k, but I think in the next few weeks, we break 18.6k support as I expect SPY to return to range lows in a few weeks.

ETH

Due to the merge narrative, ETH, from its June low, had a huge rally up to 2k.

ETH's chart looks a bit better than BTC but still doesn't look great. ETH probably is weaker than BTC from here on out because the merge narrative is over.

I expect us to break 1450 and 1270 and then chop for a bit before returning back to range lows at 1k, as I see BTC going lower.

DXY

This is one of the most bullish charts in markets, DXY is heading for a breakout of multi-year resistance, and if it does, it probably runs to 120.

If DXY reaches 120, this will rekt risk assets like growth stocks, BTC, and ETH.

Final Thoughts

I think the SPY bottoms at 3.2k-3.4k, which are the pre-Covid crash highs, while the Nasdaq bottoms at around 9-10k. The following levels on equities make me believe that BTC bottoms at 14-16k, while ETH bottoms at 800-900. These next few months will be brutal for markets, and many traders will get rekt trying to trade this price action. Capital preservation is the key for the months ahead. I think we bottom in either late Q4 or early Q1 2023, and then we chop for a while before going back to up only. Even though these are my current views, I am ready to react to any macro/cyclical change in markets. Thanks for reading.