Jupiter's Dominance on the DEX market

Flourishing Solana Ecosystem

A large part of Jupiter’s success can be attributed to the recent growth in Solana’s ecosystem. Over the past 6-12 months, onchain activity on Solana has skyrocketed due to users opting to use cheaper chains in order to avoid paying the expensive gas fees seen on Ethereum. The number of decentralized apps/protocols being built on the Solana ecosystem and the UX experience being second to none are reasons why Solana has been the primary benefactor in attracting users from Ethereum as opposed to any other L1 chain. Another thing we can attribute to Solana’s growth as a chain is the SOL price skyrocketing from the start of 2023. SOL has seen an 850% increase in price since the beginning of 2023. As many people say on Crypto Twitter, “Price going up is the best form of marketing.” The SOL token going up in price gets more people talking about it online, making it more compelling to migrate to Solana. Therefore, new users start talking about it, which fuels further user growth. It is a flywheel mechanism: the more SOL goes up in price ->the more people start dabbling into the SOL ecosystem, leading to an increase in volume and DAU (Daily active users) -> Leading to more people talking about it on social media, fueling further growth.

Source: Tradingview - SOL has seen an 850% increase since the beginning of 2023.

Brief Overview on What Jupiter is

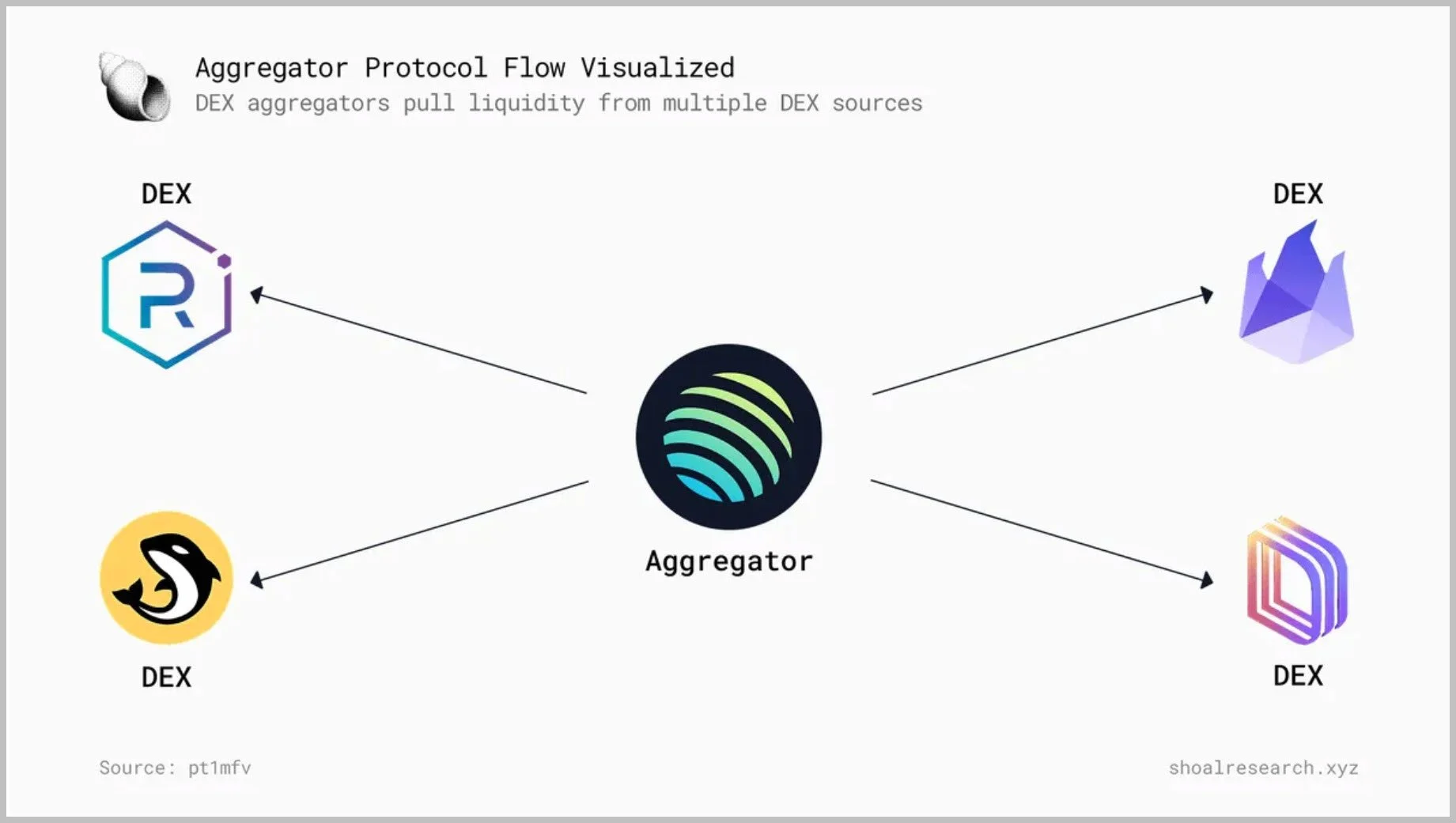

Jupiter serves as an aggregator on Solana. It means Jupiter itself isn’t a DEX (Decentralized Exchange). Instead, it aggregates liquidity from DEXes like Raydium and Orca to facilitate swaps on its platform for SOL and other SPL (Solana’s token standard) tokens.

Good visual representation on how Jupiter operates

Jupiter’s Massive Growth Visualized

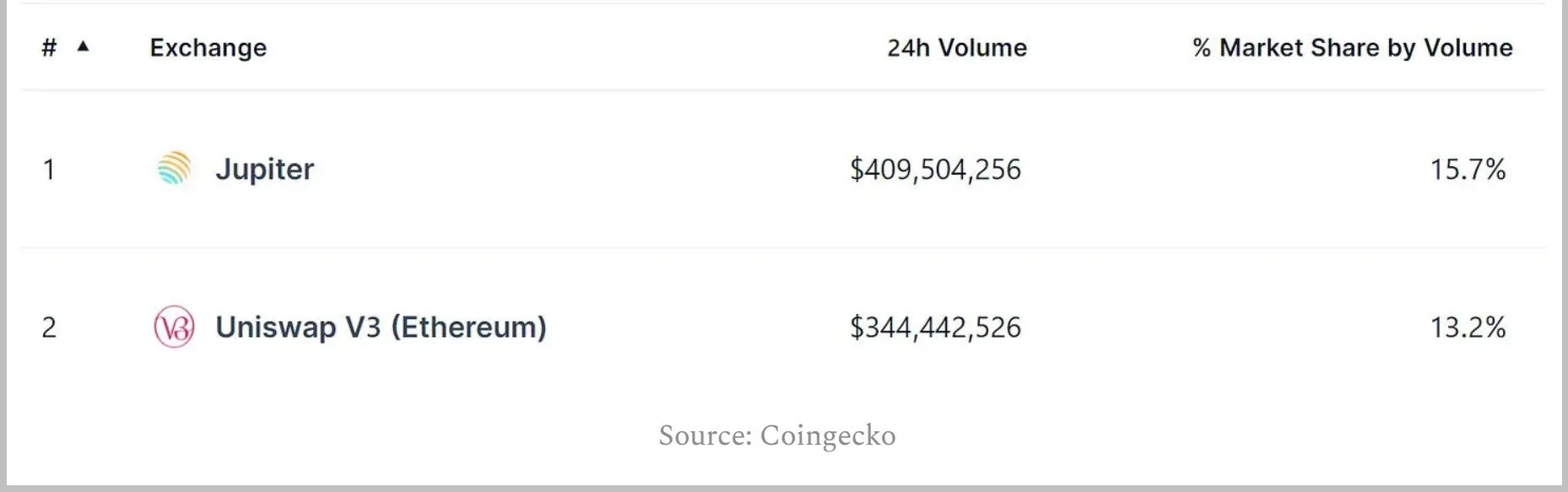

Jupiter has the highest 24-hour volume across all DEXes on any chain, as seen in the screenshot below.

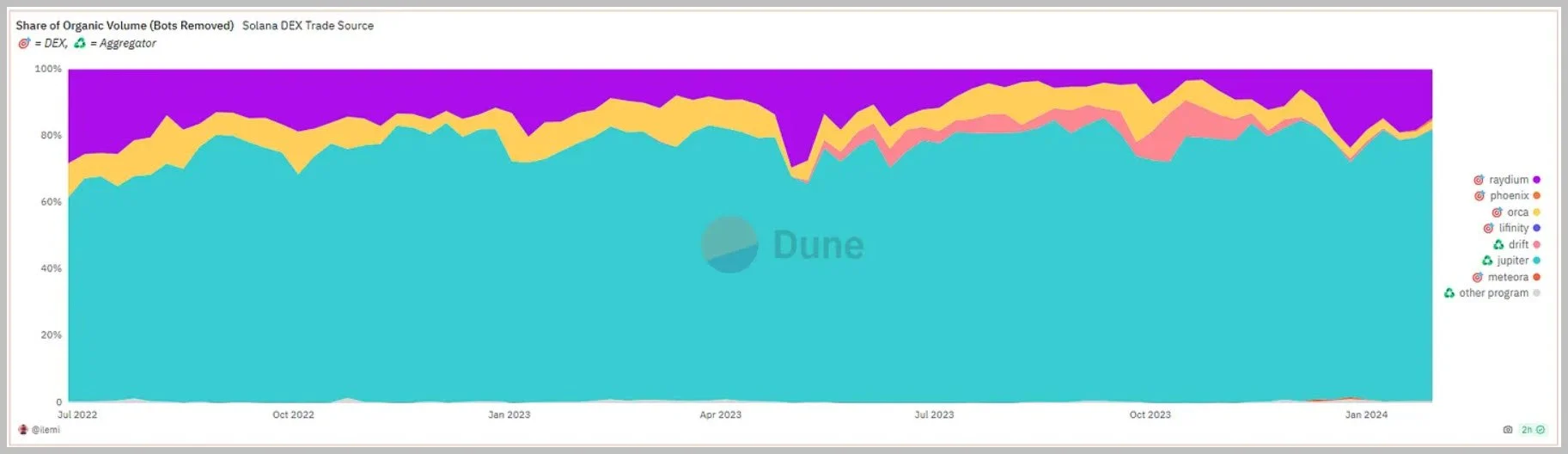

Jupiter has taken over the SOL ecosystem in the past year, boasting a large chunk of total DEX volume in the SOL ecosystem. Over the past 6 months, we can see that Jupiter has further increased its dominance from 60% to 70% market share.

Source: Ilemi Dune Dashboard

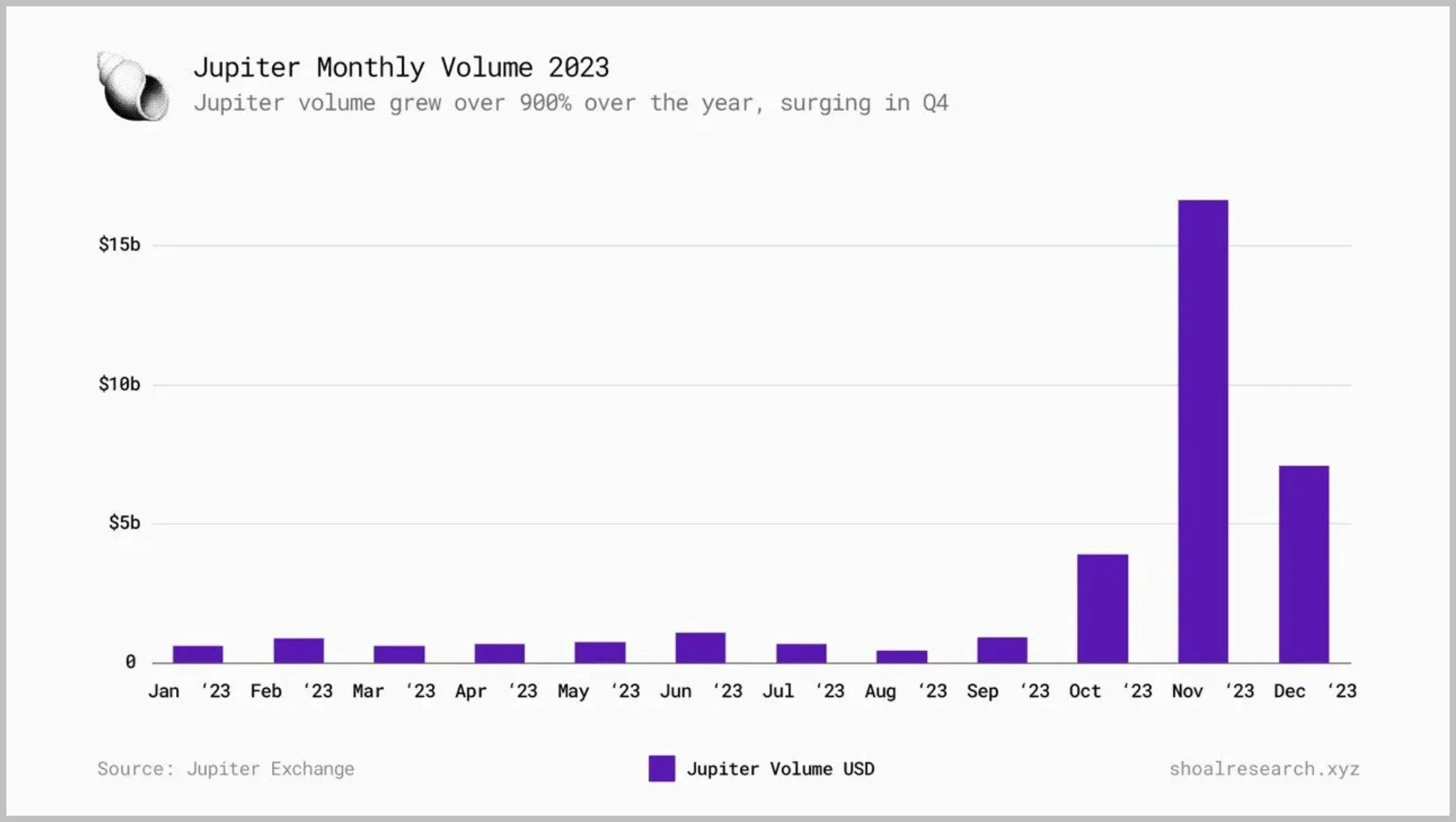

Jupiter’s monthly volume has grown rapidly over the past 12 months. We have seen a massive uptick in volume starting in q4 of 2023. However, you can see a huge spike in monthly volume in November as opposed to the other months in q4. The abnormal volume spike could be attributed to the fact that the Jupiter team announced in November that they were launching $JUP and that there would be multiple rounds of airdrops for users. People started farming to prepare for Round 2 of the airdrop by generating massive volume on the platform by facilitating repetitive swaps between two tokens, often SOL and USDC. So, it’s safe to assume that November’s monthly volume is more inorganic than other months.

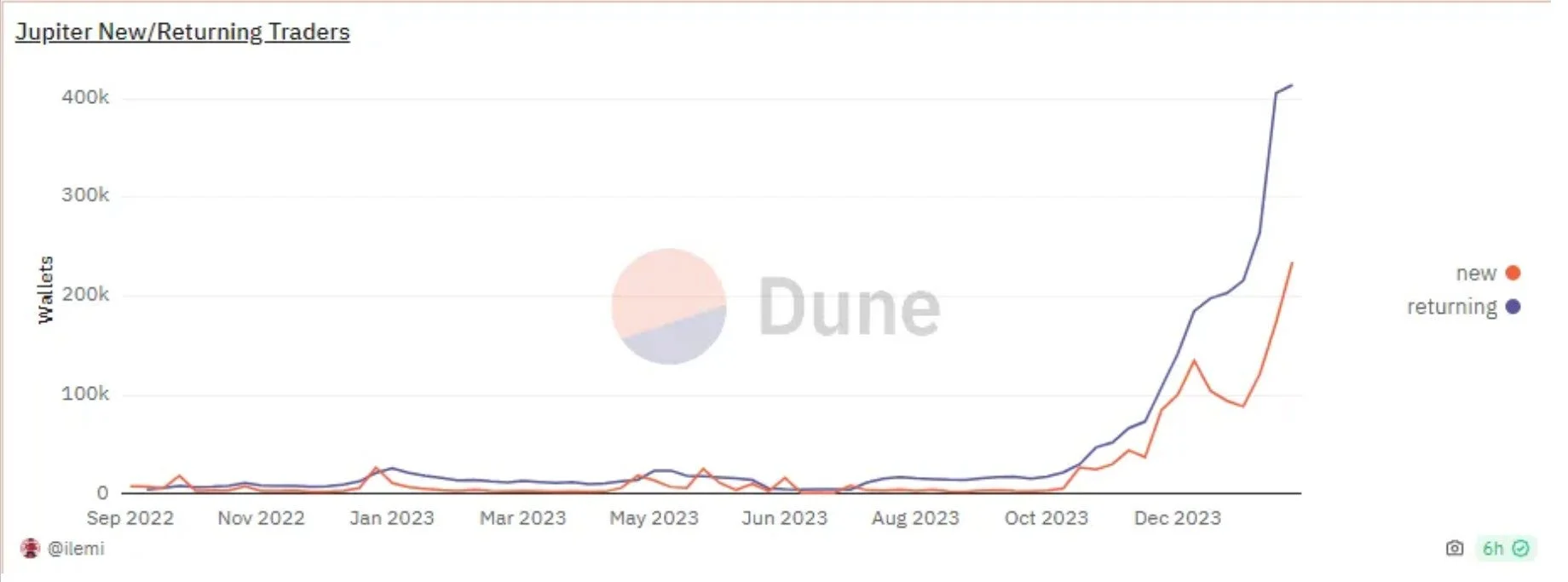

The number of users using Jupiter soared around when Jupiter’s volume took off. We saw many new wallets start to use Jupiter, leading to a jump in volume. But we also saw old wallets that had interacted with Jupiter before, beginning to return to the SOL ecosystem and engage in swaps on Jupiter.

Source: Ilemi Dune Dashboard

Reason behind Jupiter’s dominance over other Solana DEXes

Jupiter has been the number one platform when it comes to swapping tokens on Solana for a couple of reasons:

Quotes you the best price as it aggregates all the AMMs.

UX is great and very user-friendly.

The quote price gets updated in live time, allowing users to transact their tokens rapidly without constantly needing to refresh the website.

A more recent reason is the future rounds of airdrops of their token $JUP, which incentivizes users even more to use the platform consistently.

Jupiter’s Other Features

Jupiter’s main feature is the swap feature, but Jupiter contains many other features that aren’t discussed as much. Let’s walk through the other tabs in detail below.

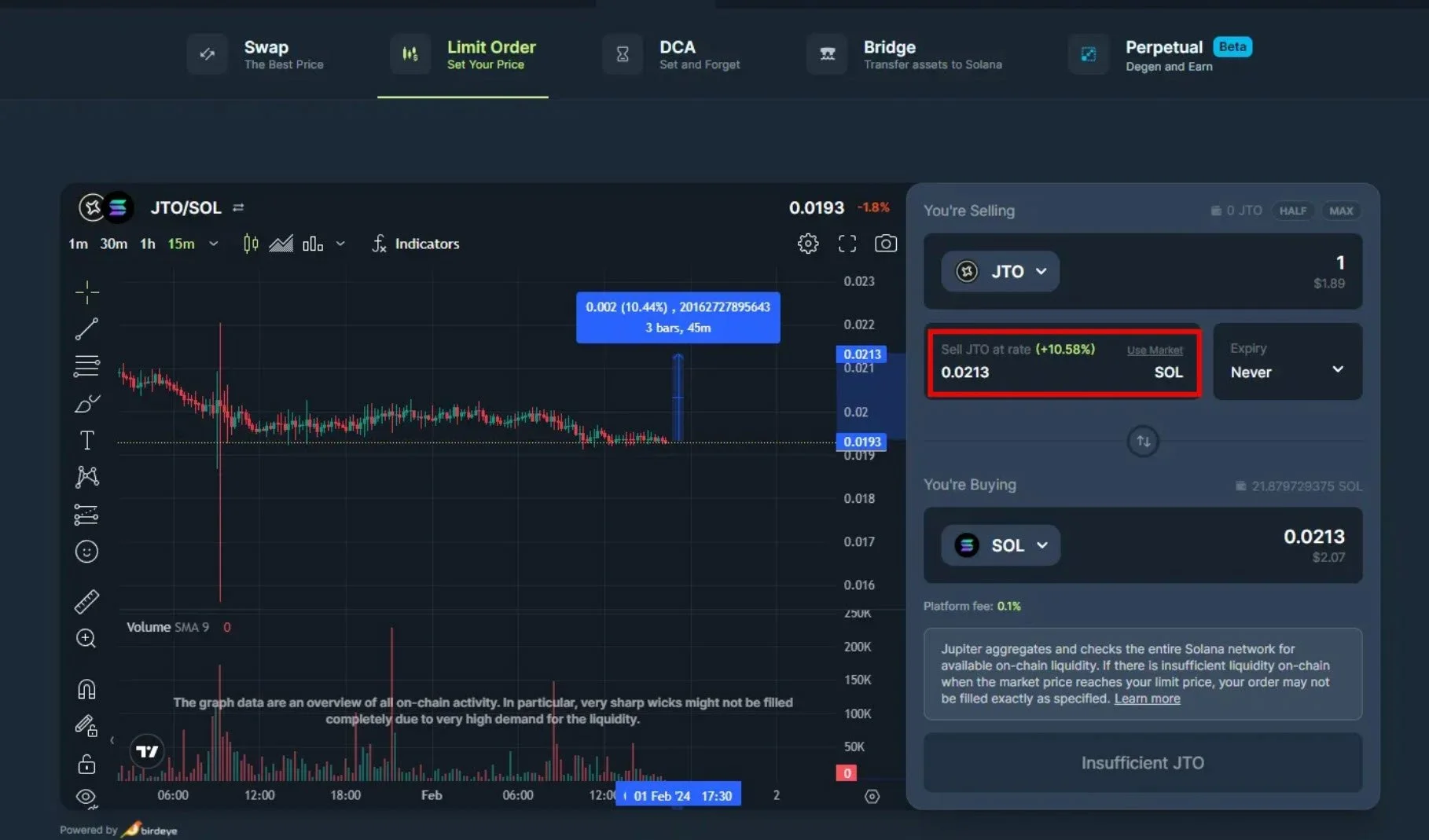

Limit Order

Limit orders are a phenomenal feature that Jupiter offers. Jupiter allows you to buy and sell tokens onchain without manually performing that action at a specific time. You can just leave a limit order, which will get triggered at a particular price depending on whether you want to buy or sell a specific token. You can choose the expiry of the order from the dropdown, which is helpful as you might want to buy only a certain token or sell a certain token during a specified period.

Another great thing about Jupiter limit orders is that you aren’t limited to buying or selling other tokens using only SOL and USDC. You can use other SPL tokens as well with the limit order feature. For example, I want to sell a particular token when it reaches a specific ratio to another token. I could set a limit order to do that as I believe the token I currently hold would be a good rotation into that other token.

For example, let’s say I wanted to sell the token JTO when the ratio of JTO to SOL is 10% higher than it currently is, as I believe that at that ratio, JTO will be a good rotation into SOL. Therefore, I would set the corresponding limit order with that ratio where I would want to rotate my JTO into SOL.

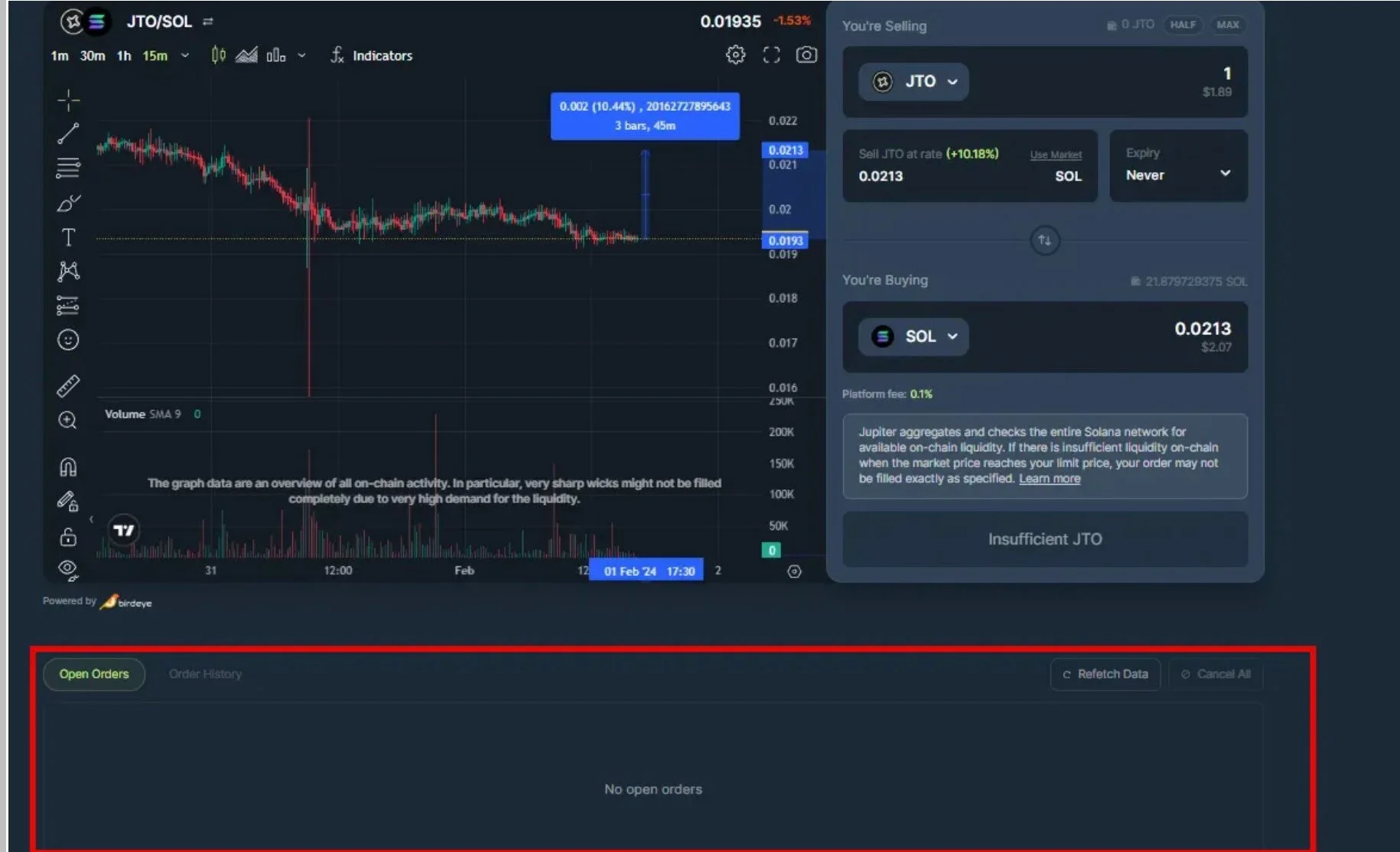

You can see your current open limit orders and your limit orders history as highlighted in the image below.

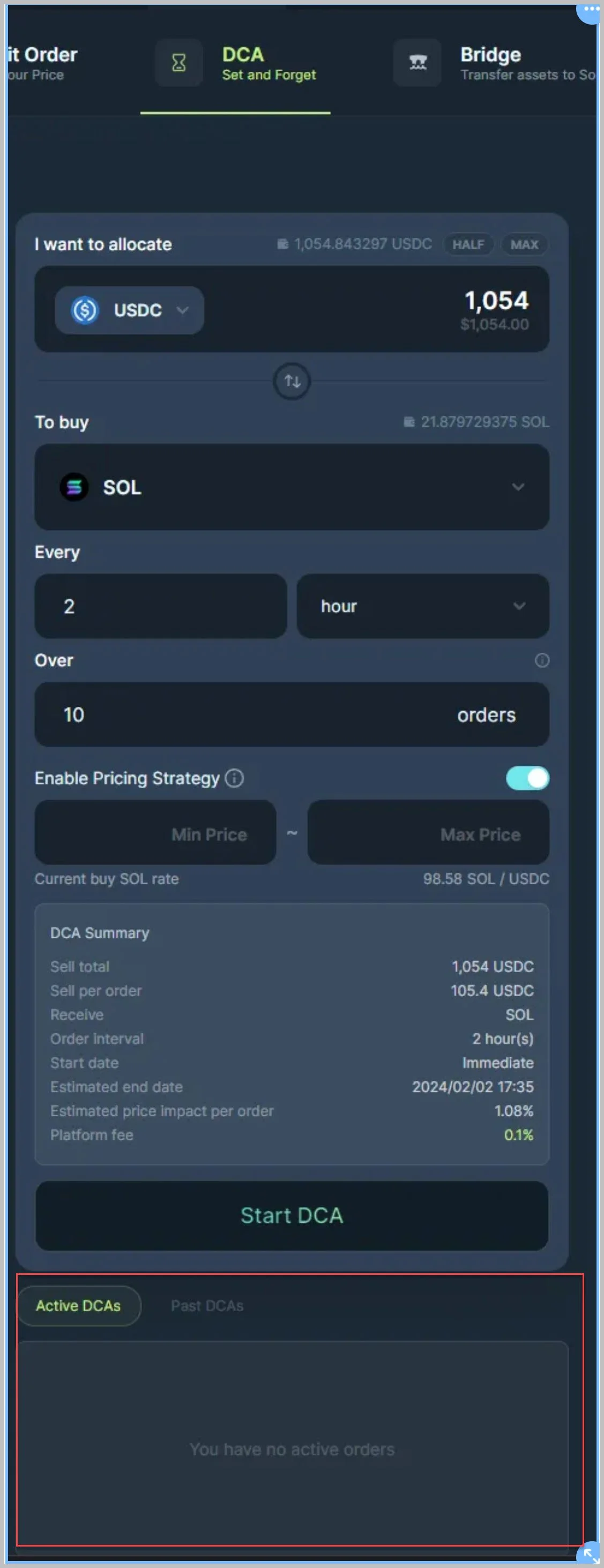

DCA

The DCA (Dollar Cost Averaging) tab allows you to buy or sell tokens gradually over a specific time interval. It is often used to buy a token over a period of time, as one might want to enter a particular token but wants the average price over a specific time interval.

The DCA feature has 5 different things we can toggle:

I want to allocate: The token you wish to use to buy the token you want.

To buy: It is self-explanatory; it is the token you want to buy.

Every: This is where you adjust the time interval for how long you want to run this DCA. You can click the dropdown to adjust from 5 different timeframes: minute, hour, day, week, and month.

Over: This lets you adjust the number of orders you want. For example, If you did 10 orders every two hours as the time interval, it would take 20 hours for your DCA to complete as one order gets filled every 2 hours.

Enable Pricing Strategy: It lets you set a minimum and maximum price that you are comfortable buying, but you can turn the toggle off if you don’t need a specific price range in your DCA orders.

You can see your current DCA orders and past DCA orders in the “Active DCAs” and “Past DCAs”.

Bridge

The bridge tab lets you move around your SOL and SPL tokens to other chains and vice versa. Jupiter offers three different options when it comes to bridging.

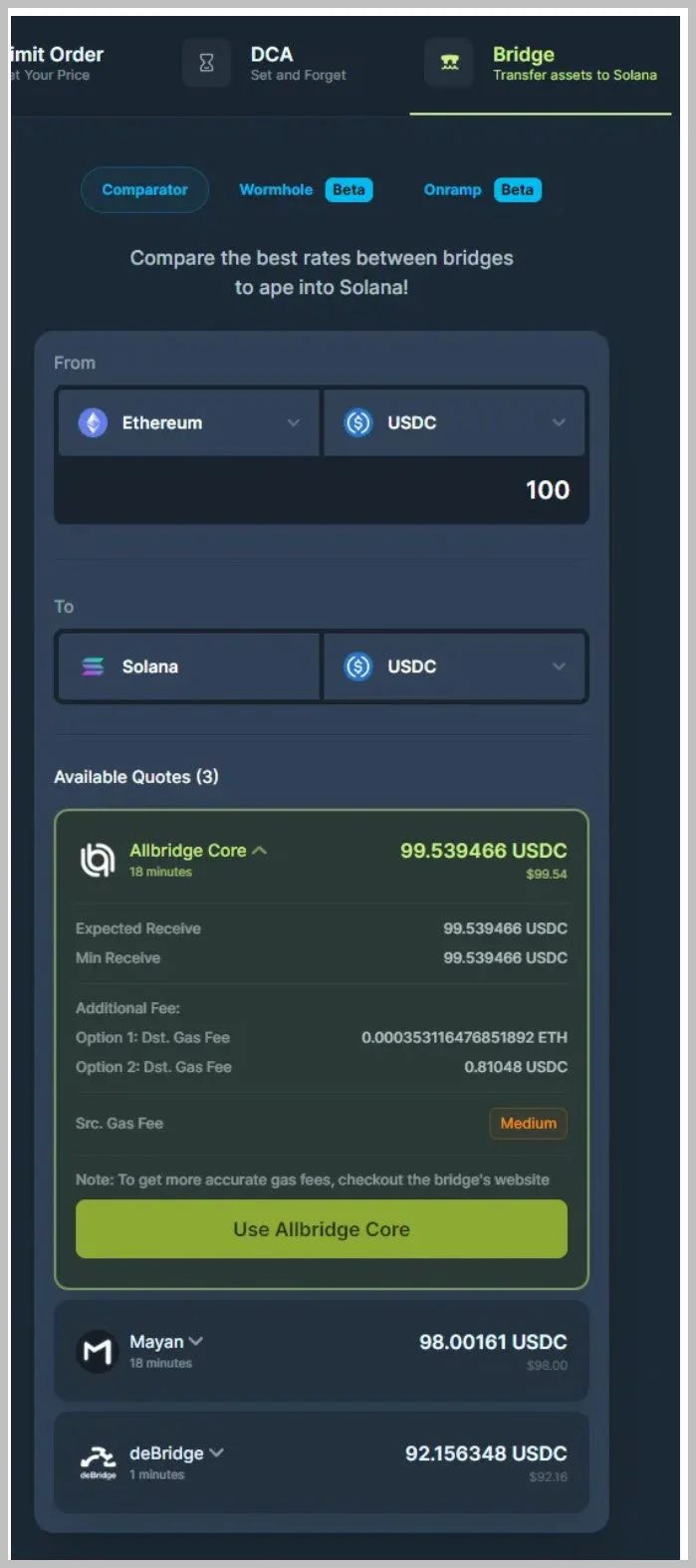

Comparator

Comparator aggregates a few bridges and allows you to choose the one with the least slippage.

Wormhole

Wormhole is a commonly used bridge which is integrated into the Jupiter platform. Wormhole often offers the best rates for bridging to and out of SOL as it has a lot of liquidity.

Onramp

This option allows you to get SOL or USDC using your credit/debit card as it is an onramp method. It isn’t as common as the first two options.

Perpetual

The Perpetual tab is the most recent feature that Jupiter has added to its website. It allows you to long or short assets using up to 100x leverage. The tradeable assets on the perpetual exchange are SOL, BTC, and ETH.

Brief Walkthrough on the Perpetual Exchange

You can enter how much collateral you want in the trade in the “You’re paying” section. Then, you can use the leverage slider or adjust the leverage by typing it to decide how much total size you want in that position. You can see your Entry price and Liquidation price depending on how much leverage you use, the Open fee you will pay, the Borrow rate, which is how much you will pay per hour, and available liquidity. Your positions and trade history are below the charting tool.

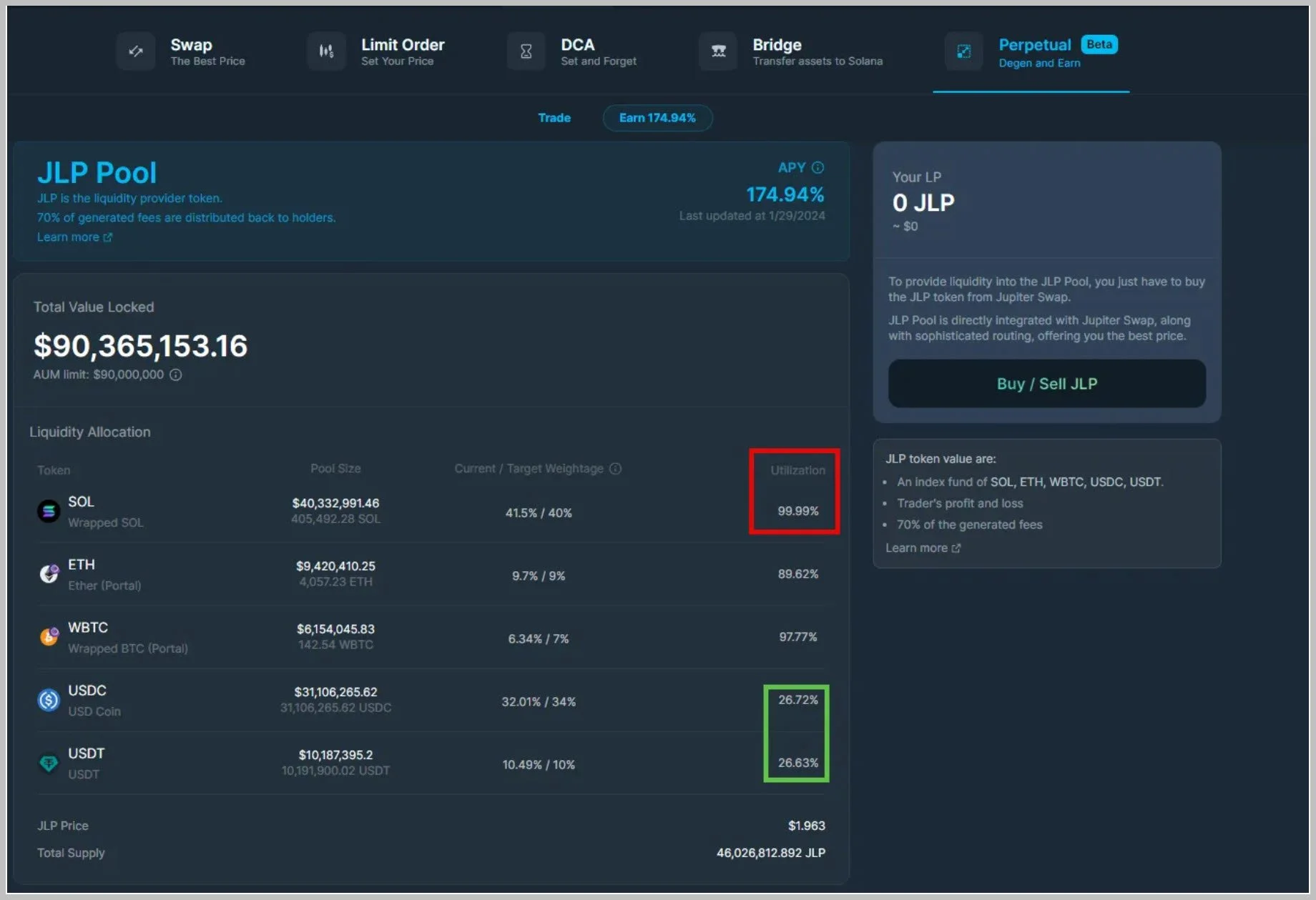

How Jupiter’s perpetual exchange operates

Jupiter’s perpetual exchange operates by using a JLP pool. JLP is a token comprising of USDC, USDT, WBTC, ETH, and SOL, and its token value is based on the cumulative PnL of traders on the platform plus the amount of fees amassed. Users provide liquidity into this pool for fees generated by the perpetual exchange. You can see the current APY on the top of the screen for people who have provided liquidity. This APY is reflexive and can quickly become much lower as it is based on the fees that the perpetual exchange amasses. The perpetual exchange can serve total size orders of up to the total amount of that asset in the pool. For example, SOL has a total pool size of around $40m. This means the total SOL borrowed for long orders can only be up to $40m. The utilization currently for SOL is maxed out, as highlighted in the red box. Max utilization means there is currently no liquidity to place longs for SOL. The stablecoins, USDC and USDT, facilitate short positions on Jupiter’s perpetual exchange. When we look at the utilization of these stablecoins, we can see that they are much less utilized than SOL, ETH, and WBTC. Low utilization means there’s a lot more liquidity currently to open shorts on SOL, ETH, and WBTC as opposed to opening long positions.

Final Thoughts

Jupiter’s dominance on the DEX market has been phenomenal, but the team hasn’t been complacent and has shipped other features to add to the trading experience on the Jupiter platform. I am curious to see what features they will add next and how they will integrate $JUP, launched on Jan 31st, into the Jupiter ecosystem.